From requirements that insurers cover prescription drugs to services of chiropractors, state health benefit mandates have a long and controversial history. Critics contend mandates drive up health insurance costs, while advocates assert they ensure access to important care. The 2010 national health reform law requires states to pay for mandated benefits for certain insured people if the mandates exceed a minimum package of covered services, known as essential health benefits. Starting in 2014, almost all nongroup and small-group insurance products, including those sold through the new state insurance exchanges, must provide essential health benefits.

Essential health benefits include 10 broad categories of services, ranging from ambulatory care to hospitalization to prescription drugs. Federal guidance indicates states can define essential health benefits by selecting a benchmark from certain existing employer-sponsored health plans offered in a state. All of the benchmark plan options generally cover a wide range of benefits, including many state-mandated benefits. Federal guidance suggests that states can avoid mandate costs by choosing a benchmark option—for example a small-group plan—subject to state mandates. But, in some states, benefit mandates for nongroup plans—which are not a benchmark option—exceed mandates for small-group plans. States then must pay for mandates not included in the benchmark plan. However, even if states leave all mandates in place, their financial liability likely will be small. Maryland provides a useful example to illustrate how benefit mandates interact with essential health benefits. Almost all of Maryland’s mandates would be included as essential health benefits, regardless of which benchmark plan the state selects. Maryland’s liability in 2016 would range from about $10 million to $80 million—depending on the benchmark plan selected—if the state retained all mandates.

- Benefit Mandates Draw Controversy

- Putting Mandates in Context

- Rethinking Benefit Mandates

- Essential Health Benefits

- Mandates Beyond Essential Health Benefits

- Small-Group Plan as Safe Harbor?

- An Example: Mandate Costs in Maryland

- Looking Ahead

- Notes

- Data Source

Benefit Mandates Draw Controversy

Currently, many states have laws—known as benefit mandates requiring health insurers to cover certain medical services, conditions and providers. Benefit mandates vary considerably by state, ranging from coverage for emergency services to autism treatment to care provided by a chiropractor. State mandates only apply to nongroup plans and fully insured small-group and large-group plans. The 1974 Employee Retirement and Income Security Act, or ERISA, exempts private-sector employer plans that self-insure, or bear the financial risk of enrollees’ medical care, from state insurance regulation, including benefit mandates.1 Among Americans with private coverage, roughly 45 percent are in health plans subject to state benefit mandates.2

Benefit mandates are controversial. Some view them as consumer protections that ensure access to important care, while others contend mandates are promoted by narrow special interests and add significant cost but marginal benefits. Research, however, suggests that benefit mandates have less impact than portrayed by both proponents and opponents—many state mandates require such benefits as emergency services or prescription drugs, which are included by most health plans whether they are subject to such a mandate or not.3 Currently, any increased costs associated with state benefit mandates are passed along to policyholders through higher premiums and patient cost sharing.

Starting in 2014, all nongroup and fully insured small-group plans—except so-called grandfathered plans—will be required to provide an essential health benefits (EHB) package.4 The health reform law defines a small group as employers with 100 or fewer full-time-equivalent workers, although states initially can define a small employer as one with up to 50 workers. States can leave benefit mandates in place that exceed the EHB package but will have to pay the costs of the additional benefits for enrollees in certain nongroup and small-group plans. The U.S. Department of Health and Human Services (HHS) has indicated that it intends to define essential health benefits through benchmark plans selected by each state based on existing employer-sponsored plans or the largest commercial health maintenance organization (HMO) in each state.

This analysis describes the range of current state benefit mandates, federal health reform law provisions that will affect state approaches to benefit mandates, and the benchmark plans that states can use to define the essential health benefit package for new nongroup and fully insured small-group health plans. The analysis also examines Maryland, a state with a wide array of benefit mandates, to illustrate how mandates interact with essential health benefits.

Putting Mandates in Context

Dating to the 1970s, state benefit mandates originally were a way for non-physician providers, such as dentists and social workers, to receive reimbursement from insurers for providing services. Beginning in the 1990s, public anxiety about managed care plans’ more-restrictive coverage practices prompted states to pass a number of new mandate laws that apply to specific medical services.5 More recently, state mandate laws have expanded to include such services as in vitro fertilization, in addition to more routine services, such as emergency care and mental health treatment.6 Today, mandates vary considerably by state, with the number ranging from 13 in Idaho to 69 in Rhode Island.7 The mere number of mandates is a poor indicator of their impact, however, because many plans offer the mandated services whether they are required to or not. For example, three of the most common state mandates include emergency department services (45 states), treatment of alcoholism and substance abuse (46 states) and diabetic supplies (47 states)8—all services typically covered by health plans regardless of whether they are subject to specific mandates.

There are several different types of mandate laws. Some require insurers to provide or offer coverage of specific health benefits, such as cancer screenings or prescription drugs. Other mandates require treatment of certain conditions, for example, autism or infertility. And, still others require coverage of certain providers, including dentists and chiropractors. In addition, some mandates may specify a minimum level of coverage for a particular benefit, for example, inpatient mental health care of at least 20 days, and some mandates specify parity—a concept that if a plan covers certain benefits or providers, it must cover them at the same coverage level as other benefits or providers. Some mandates also require plans to offer coverage to certain categories of individuals, such as dependent coverage through age 30.

Rethinking Benefit Mandates

The 2010 Patient Protection and Affordable Care Act (PPACA) introduces new federal regulation of the nongroup and small-group insurance markets in 2014 that may cause states to review benefit mandates:

- In the nongroup and fully insured small-group markets, all new plans will be required to provide an essential health benefits package—large-group plans, whether fully or self-insured, are exempt from EHB requirements.

- Nongroup and small-group plans that provide essential health benefits and meet additional requirements will be designated by states as qualified health plans (QHPs).

- States will be required to have health insurance exchanges that sell qualified health plans to individuals and small groups. Insurers also can offer QHPs to individuals and small groups outside of the state exchanges. Individuals with incomes below 400 percent of the federal poverty level—$44,680 in 2012—who purchase QHPs through the exchanges will receive federal subsidies to assist with premium costs.

- States will be allowed to mandate benefits that exceed the essential health benefits package, but they will have to pay for the cost of the additional benefits for all QHP enrollees—not just those purchasing through the exchanges and receiving federal premium subsidies.9

There has been persistent confusion on this last point because of the legislative history of PPACA. An early version of the legislation (H.R. 3590 Engrossed Amendment Senate) only required that states defray the costs of mandated benefits for people enrolled in nongroup QHPs who receive exchange subsidies. However, that language was amended before passage (H.R. 3590 Enrolled Bill, Sec. 10104) to state explicitly that states must defray costs of mandates for all QHP enrollees, whether receiving an exchange subsidy or not.

Essential Health Benefits

Starting in 2014, PPACA will require all non-grandfathered plans sold in the small-group and nongroup market, including all QHPs, to provide essential health benefits that include 10 categories of services: ambulatory patient services; emergency services; hospitalization; maternity and newborn care; mental health and substance use disorder services, including behavioral health treatment; prescription drugs; rehabilitative and habilitative services and devices; laboratory services; preventive and wellness services and chronic disease management; and pediatric services, including oral and vision care.

The law also requires that the essential health benefit package match “the scope of benefits provided under a typical employer plan” and “reflect an appropriate balance among the categories. . .so that benefits are not unduly weighted toward any category.”10 PPACA directs the HHS secretary to define essential health benefits beyond these requirements.

Federal Guidance

The Department of Health and Human Services has issued guidance outlining its intended approach to defining essential health benefits.11 Under the guidance, states would select a benchmark plan as a starting point in defining essential health benefits from one of the following options:

- one of the three largest—as determined by enrollment—small-group insurance products in the state;

- one of the three largest state employee health plans;

- one of three largest Federal Employee Health Benefit Program (FEHBP) plan options; or

- the largest insured commercial HMO in the state.

If a state does not select a benchmark plan, HHS has proposed making the default benchmark plan the largest plan by enrollment in the state’s largest small-group product.

Some services will be included as essential health benefits even though they typically are not included in any of the benchmark options. For example, habilitative services—often defined as services to attain a new function or skill in contrast to rehabilitative services that focus on restoring function or skills—typically are not covered by employer plans and likely would not be included in a benchmark plan. But habilitative services are specifically included in one of the 10 required essential health benefit categories. In cases such as habilitative services, HHS intends to require that the benchmark plan be augmented to include the required essential health benefits category.

Mandates Beyond Essential Health Benefits

Few benefit mandates are likely to exceed a state’s essential health benefit package, regardless of which benchmark plan a state selects. According to the HHS guidance, the FEHBP Blue Cross Blue Shield standard option includes 95 percent of state benefit mandate categories, and many common state mandates are covered consistently across all benchmark types—examples include emergency services, inpatient and outpatient services for mental health and substance use disorders, prescription drugs, prosthetics, well-child services, and preventive services. The scope of benefits in various benchmark plans is similar, according to HHS, and major differences among plan types relate more to cost sharing than to covered services.

However, there are some state mandates that are not covered consistently by benchmark plans. For example, in vitro fertilization services for infertility and applied behavioral analysis therapy for autism are covered by some small-group plans but not typically included in the FEHBP or in state employee plans. Other services, such as dental care, acupuncture, bariatric surgery, hearing aids and smoking-cessation treatment, are covered by the FEHBP but are not consistently covered by the other benchmark options.

A common state mandate is parity for mental health treatment, which requires that coverage of these services be no more restrictive than coverage of medical or surgical benefits. It is unlikely that states will have to pay for mental health parity mandates because HHS intends to propose that federal parity requirements under the Mental Health Parity and Addiction Equity Act of 2008 apply to essential health benefits.

Small-Group Plan as Safe Harbor?

Unlike FEHBP and state employee plans, which are often self-insured, most small-group plans are fully insured and, therefore, subject to state regulation, including benefit mandates. HHS, in allowing states to choose a small-group plan as the benchmark, appears to give states an option that includes all of their existing mandates and avoids any liability.

In some states, however, different benefit mandates apply in the small-group and nongroup markets. Those states could face liability for benefit mandates, even if they select a small-group plan as their benchmark. For example, in Maryland small-group plans are not mandated to cover in vitro fertilization or treatment of morbid obesity—two mandates that apply in Maryland’s nongroup market.12 Another example is Connecticut, where a mandate relating to blood-lead screening/risk assessment applies only in the nongroup market.13 If Maryland and Connecticut selected a small-group plan as their benchmark and left these individual-market mandates in place, they would be required to pay the cost of these mandates for nongroup enrollees in qualified health plans.

For years 2016 and beyond, HHS has indicated it may exclude certain mandates from states’ essential health benefits package. It is unclear whether HHS would simply determine that certain benefits covered by the states’ benchmark plan would no longer be considered essential health benefits, or whether HHS would decide to take an entirely new direction and greatly modify or replace the benchmark approach and provide much greater specificity on services to be covered.

An Example: Mandate Costs in Maryland

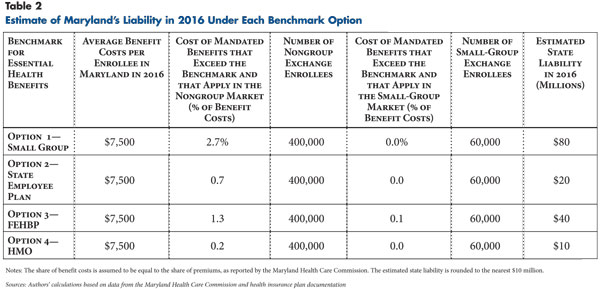

It is useful to understand the approximate cost states would face for mandated services under each benchmark option. In Maryland, most mandates are covered by each benchmark option, with the exception of a few mandates excluded under one or more benchmarks, such as in vitro fertilization, treatment of morbid obesity and smoking-cessation treatment.

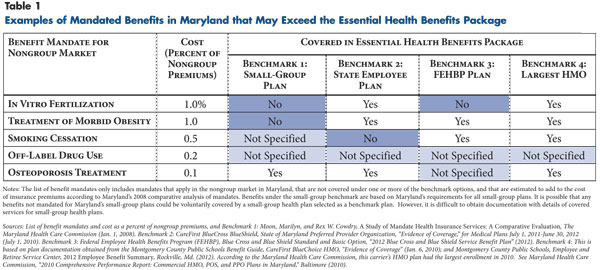

HHS has not yet clarified how it will assess financial liability for state benefit mandates. However, each state’s liability for benefit mandates will generally be driven by three key factors—the number of enrollees in qualified health plans in the state, the average premium for a QHP in the state, and the share of the premium costs attributable to mandated benefits that exceed the benchmark plan. Using data from Maryland, it is possible to calculate a rough estimate of the state’s liability for benefit mandates under each benchmark scenario.

Number of QHP enrollees. Qualified health plan enrollees will include anyone who enrolls through an exchange. Based on Congressional Budget Office (CBO) projections, there will be roughly 460,000 people enrolled through Maryland’s state exchange in 2016—400,000 in nongroup plans and 60,000 in small-group plans.14 It is important to distinguish between these two groups because Maryland applies different benefit mandates in the two markets. There could also be enrollees in QHPs offered outside of Maryland’s exchange—for the purposes of this illustration, any such QHP enrollees are excluded.15

Average benefit costs per enrollee in QHPs. The average qualified health plan premium in Maryland in 2016 will be approximately $5,200, and the average benefit costs per enrollee for a typical plan will be roughly $7,500—covered benefits includes amounts paid by the insurer plus cost sharing paid by the patient. This estimate is based on CBO projections of a typical exchange plan premium with an actuarial value of 72 percent, excluding the insurer’s administrative load, in all states in 2016,16 and Maryland’s health spending per capita relative to the U.S. average.17

Share of benefit costs attributable to state benefit mandates exceeding essential health benefits. The benefit costs for state mandates that exceed essential health benefits will vary depending on which benchmark option Maryland selects. The Maryland Health Care Commission has estimated the share of premium costs attributable to specific mandates.18 Based on those estimates, the costs for benefit mandates that exceed essential health benefits, as a share of total benefit costs, will range from approximately 0.2 percent if Maryland selects the largest HMO as the benchmark to 2.7 percent if Maryland selects a small-group plan as the benchmark.

The HMO plan has the most comprehensive benefits and includes all of Maryland’s nongroup mandates, with the possible exception of off-label drug use (off-label drug use is specifically mandated in the nongroup market, and it is not specified as covered or not covered in the HMO plan). The state employee plan is the second-most comprehensive—it covers in vitro fertilization and treatment of morbid obesity, which are mandated in the nongroup market, but it does not cover smoking cessation and does not specify coverage of off-label drug use. The FEHBP plan is the third-most comprehensive—it does not cover in vitro fertilization or specify coverage of off-label drug use or osteoporosis treatment. The small-group benchmark, as indicated by coverage requirements for Maryland’s small-group health plans, is the least comprehensive—it specifically excludes in vitro fertilization and treatment of morbid obesity and does not specify coverage of off-label drug use and smoking cessation, all of which are mandated in Maryland’s nongroup market (see Table 1).

Based on estimates for the number of enrollees in qualified health plans in the state, the average premium for a QHP in the state, and the share of the benefit costs attributable to mandated benefits that exceed the benchmark plan, the total cost for Maryland’s benefit mandates would range from $10 million for the HMO benchmark to $80 million for the small-group benchmark (see Table 2). Differences in costs reflect differences in the coverage of a few mandates across the four benchmark plans. These costs are nontrivial, but they are small relative to the costs that states face for other components of health reform, such as expanded Medicaid coverage.

Looking Ahead

With coverage through the exchanges beginning Jan. 1, 2014, states will need to select a benchmark option soon. Insurers will need to design plans by late 2012 to allow states enough time to certify qualified health plans and to prepare for an open-enrollment period for the exchange plans, scheduled for the second half of 2013.19 When selecting a benchmark plan and deciding whether to keep state benefit mandates, key considerations for states include the following:

Selecting a small-group plan as the benchmark is not a sure bet. HHS has signaled that states can avoid liability for benefit mandates by selecting a small-group plan as their benchmark. But, state policy makers need to consider two factors before selecting the small-group option. First, some states apply mandates in the nongroup market that go beyond those in the small-group market, and those states would face liability if they select a small-group benchmark. In Maryland, the

small-group benchmark actually would result in the largest liability compared to the three other benchmarks. Second, HHS has indicated that it may, beginning in 2016, start to exclude some state benefit mandates from essential health benefits even if they are covered in a state’s benchmark plan.

Regardless of the benchmark plan chosen, states are unlikely to face large liabilities for benefit mandates. In general, the four different types of benchmark plans are similar to each other in their scope of benefits, and most benefit mandates will be covered by any of the benchmark options. When selecting a benchmark plan, it is reasonable for states to take into consideration their potential liability for benefit mandates. But, the range of potential liabilities is fairly narrow, and other considerations should not be overlooked. For example, the establishment of multi-state exchanges would likely be eased by using an FEHBP option as the benchmark, since these plans are uniform across states.

As the entity selecting a benchmark and certifying QHPs, states will have a new way, besides benefit mandates, to assure adequate benefits. With the implementation of the exchanges, states will have new mechanisms for regulating the scope of benefits in the nongroup and small-group markets. Since states will be selecting a benchmark plan to regulate the benefits covered, the regulatory focus can shift from service-specific benefit mandates to a broader focus on the overall scope of benefits that are covered. States also can use their authority to certify QHPs as a way of excluding plans that offer inadequate benefits. This authority can be used in addition to—or instead of—benefit mandates.

PPACA will prompt state policy makers to consider the trade-off between the cost of mandated benefits and the additional value they provide to policyholders. If states choose to keep benefit mandates or to apply new mandates, they should prepare to quantify the costs and benefits of mandated services. States could use the establishment of the exchanges as an opportunity to set up a system, similar to the one in operation in Maryland, for systematically assessing the cost and value of various mandates.20

Notes

1. In recent years, some states have enacted laws allowing insurers to offer limited-benefit plans, which are exempt from most or all state mandates, in the small-group market. Though states authorized these plans in part to allow small employers to offer insurance coverage at a lower cost, evidence shows limited-benefit plans only reduce premium costs by a small amount, typically between 5 and 9 percent. See Robert Wood Johnson Foundation, State Coverage Initiatives, Limited-Benefit Plans: Overview, Washington, D.C. (2010).

2. Authors’ calculation based on data from Kaiser Family Foundation (KFF)/Health Research and Educational Trust, Employer Health Benefits 2011 Annual Survey, Washington, D.C. (September 2011); and Congressional Budget Office (CBO), Key Issues in Analyzing Major Health Insurance Proposals, Washington, D.C. (December 2008).

3. Centers for Medicare and Medicaid Services (CMS), Center for Consumer Information and Insurance Oversight (CCIIO), Essential Health Benefits Bulletin, Baltimore (Dec. 16, 2011).

4. Grandfathered plans in the nongroup and fully insured small-group markets will be exempt from the EHB requirement. Grandfathered plans are plans that existed before enactment of the health reform law on March 23, 2010, that maintain certain components of the plan relating to covered benefits, cost sharing and employer premium contributions. See Fernandez, Bernadette, Grandfathered Plans Under the Patient Protection and Affordable Care Act (PPACA), Congressional Research Service, Washington, D.C. (June 7, 2010).

5. Laugesen, Miriam J., et al., “A Comparative Analysis of Mandated Benefit Laws, 1949-2002,” Health Services Research, Vol. 41, No. 3, Part II (June 2006).

6. Monheit, Alan C., and Jasmine Rizzo, Mandated Health Insurance Benefits: A Critical Review of the Literature, New Jersey Department of Human Services, Trenton, N.J., and Rutgers Center for State Health Policy, New Brunswick, N.J. (January 2007).

7. Bunce, Victoria Craig, and J.P. Wieske, Health Insurance Mandates in the States 2010, Council for Affordable Health Insurance, Alexandria, Va. (October 2010).

8. Ibid.

9. PPACA, Public Law No. 111-148, Section 1311(d)(3)(B).

10. PPACA, Public Law No. 111-148, Section 1302(b)(2)(A) and 1302(b)(4)(A).

11. CCIIO (Dec. 16, 2011); and CCIIO, Frequently Asked Questions on Essential Health Benefits Bulletin, Baltimore (Feb. 17, 2012).

12. Moon, Marilyn, and Rex W. Cowdry, A Study of Mandated Health Insurance Services: A Comparative Evaluation, Maryland Health Care Commission, Baltimore (Jan. 1, 2008).

13. University of Connecticut, Center for Public Health and Health Policy, Connecticut Mandated Health Insurance Benefits Reviews 2010, Vol. II, East Hartford, Conn. (January 2011).

14. The 400,000 enrollees in nongroup exchange plans represents nearly the whole of the nongroup market, while the 60,000 exchange enrollees in small-group plans represents only a small share of the small-group market—the number of small-group QHP enrollees could be much higher if large numbers of enrollees in small-group plans are in QHPs outside the exchange. See CBO, CBO’s March 2011 Baseline: Health Insurance Exchanges, Washington, D.C. (March 18, 2011); and KFF, Maryland, Facts at a Glance, Menlo Park, Calif. Last accessed on Jan. 15, 2012, at http://www.statehealthfacts.org/profileglance.jsp?rgn=22.

15. At this point, it is unclear whether or how individuals would be able to enroll in QHPs from outside the exchange.

16. CBO, An Analysis of Health Insurance Premiums Under the Patient Protection and Affordable Care Act, Washington, D.C. (Nov. 30, 2009).

17. As of 2009, Maryland’s per capita annual health spending was $7,492, which was slightly higher than the national average of $6,815. CMS, Health Expenditures by State of Residence, Baltimore (December 2011). See KFF, Maryland, Facts at a Glance, Menlo Park, Calif. Last accessed on Jan. 15, 2012, at http://www.statehealthfacts.org/profileglance.jsp?rgn=22.

18. Moon and Cowdry (Jan. 1, 2008).

19. PriceWaterhouseCoopers Health Research Institute, Change the Channel: Health Insurance Exchanges Expand Choice and Competition, Dallas (July 2011).

20. As of December 2011, 33 states have laws that require an evaluation of mandated benefits. See National Conference of State Legislatures, State Health Insurance Mandates and the ACA Essential Health Benefits Provisions, Denver (Jan. 30, 2012).

Data Source

In addition to performing a literature review, HSC researchers used data reported by the Maryland Health Care Commission and the Congressional Budget Office and conducted interviews with state and federal health policy experts.